When should I get on a family plan or switch to a new one?

A family cover includes 1 or 2 adults and an unlimited number of qualifying dependants. If you are a couple with plans to start a family, you should start thinking about getting on a family plan. A couples-plan holders must transfer to a family plan within 2 months of the baby’s birth in order to avoid waiting periods. If you sign up for a family plan after your first child’s birth, there will be a 12-month waiting period to access maternity benefits. So if you are planning to have more than one child, getting on a family plan as early as possible would be advisable .

The right coverage depends on the life stage of your family. As the family matures in age, the medical needs would also evolve. Thus, you’d want to review your coverage every 2-3 years and upgrade or switch to a more suitable plan when sensible.

Types of family health insurance to consider

Just like all other health insurance plans, family health insurance has three buckets which could be combined if desired: Hospital cover, extras cover, and ambulance cover. For families with young children, you may want to get all three to cover a wide range of eventualities and medical needs. Most providers would allow you to mix and match and combine all into one simple plan to make it easy to manage.

Hospital Cover

Starting April 2020, all private hospital covers had to offer their products by a standardised tiering system : Gold, Silver, Bronze, and Basic. Each tier has its list of clinical services required to be covered but each provider could offer more if desired. It gives customers a more consistent set of standards to compare the plans available on the market. For instance, Gold is the only tier where obstetrics is included as a required hospital treatment. You should consider the hospital treatments (including likely or possible future needs) you or your family members may require and choose the tier you feel comfortable with.

Extras Cover

Unlike the hospital cover, extras covers are not as regulated or standardised. The range of services covered by the extras covers would really depend on each provider. This is where your choice would be impacted by your family’s life stage. If you have young children, you may want more coverage in case of accidents and to make sure that you are able to get them glasses or braces if needed as they get older.

Ambulance Cover

More than 3.5 million Australians use the ambulance service each year. Tasmania and Queensland provide free emergency ambulance services but other states do not. Thus, the out-of-pocket costs could be surprisingly high when one has to unexpectedly call triple zero in urgent situations. Some hospital covers would include ambulance services while some would require you to get an ambulance cover separately. Regardless, you’d be able to combine with your hospital and extras cover into one family plan.

Best Family Health Insurance Plans

Below are some of the best providers and the hospital &extras covers they offer. The estimated prices for the following plans are based on separate hospital and extras covers but combined plans may be cheaper. Hospital covers are assuming $750 excess.

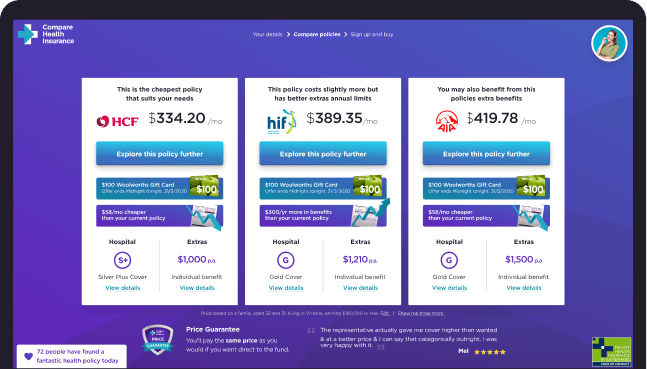

In order to find the one that suits your family’s unique needs, use our comparison tool to get more personalised recommendations.

1. Medibank

- Weekly price ranging from $15 to $25

- 60 - 90% claim back from Members’ Choice providers

- Includes dental, optical, physio, and more

2. NIB

- Weekly price ranging from $18 to $25

- 60 - 90% claim back from Members’ Choice providers

- Includes dental, optical, physio, and more

3. HCF

- Weekly price ranging from $4 to $34

- Increasing loyalty limits

- Includes dental, optical, therapies, postnatal services, and more

4. Bupa

- Weekly price ranging from $6 to $59

- Increasing loyalty limits

- Includes dental, optical, physio &other therapies, mental health, remedial massage, home nursing, and more

5. Australian Unity

- Weekly price ranging from $10 to $54

- Includes dental, optical, therapies (physio, chiro, etc.), travel vaccinations, dietetics, acupuncture, alternative medicines, and more